Breaking News

Minnesota Annualized Income Installment Worksheet

вторник 07 апреля admin 34

Minnesota Annualized Income Installment Worksheet Rating: 7,4/10 4355 votes

Annualized Income Installment: North Carolina: Form NC-478: Tax Credits Limited to 50% of Tax: North Carolina: Form NC-478G: Credit for Investing in Renewable Energy Property: North Carolina: Form NC-478L: Credit for Investing in Real Property: North Carolina: Form NC-478 (PT) Pass-Through Schedule: North Carolina: Form NC-40: Estimated Income Tax: North Carolina: Form D-400V. Comments About Tax Map. IRS.gov Website. Annualized Income Installment Method. View: Publications Publications. Links Inside Publications. Publication 505 - Tax Withholding and Estimated Tax - How To Figure Each Payment. Annualized Income Installment Method. If you don’t receive your income evenly throughout the year (for example.

An annualized plan is a one-year, four-period plan that calculates federal quarterly estimated payments. Annualized plans allow you to provide different quarterly payment amounts for clients whose income is earned unevenly throughout the year (for example, a client with income from a seasonal business or with large capital gain transactions at the end of the year).

Note: To print Form 1040-ES vouchers, see Print IRS forms.

Creating annualized plans

To create an annualized plan, mark the Annualized Plan checkbox in the New Plan dialog when adding a new plan. The entry in the Number of Alternatives field changes to 4, and the Number of years field changes to 1.

Note: Annualized plans are only federal plans; states cannot be added.

Working with annualized plans

Annualized plans cover one year and four periods: 1/1-3/31, 1/1-5/31, 1/1-8/31, and 1/1-12/31.

If the AutoSpread feature is turned on, any data that you enter spreads appropriately to the columns to the right. The AutoSpread feature spreads income and deduction amounts in such a way that assumes that the income or deductions are earned or paid evenly throughout the year. Amounts that should not vary with each column, such as the Taxpayer dependents field in the Main > Exemptions tab, will copy to each column without changing their value.

AutoSpread will not overwrite amounts you have previously entered in columns to the right.

Note: You can override any amounts inserted by the AutoSpread feature, and you can turn off the AutoSpread calculation by clicking the Auto-spread Annualized button on the toolbar.

Calculations in annualized plans

Planner CS calculates minimum required quarterly estimated tax payments in the Payments > Annualized tab. This tab replicates the Annualized Estimated Tax Worksheet found in IRS Publication 505. Planner CS displays the taxpayer's required quarterly estimated payments in the 26d. Estimated tax pmt reqd field at the bottom of this screen. Enter the taxpayer's actual quarterly payments made (which may or may not equal the required payment) on the Payment > Federal Pmts tab. For additional information about entering federal payments for an annualized plan, click the 1st ES payment through 4th ES payment fields and press F1.

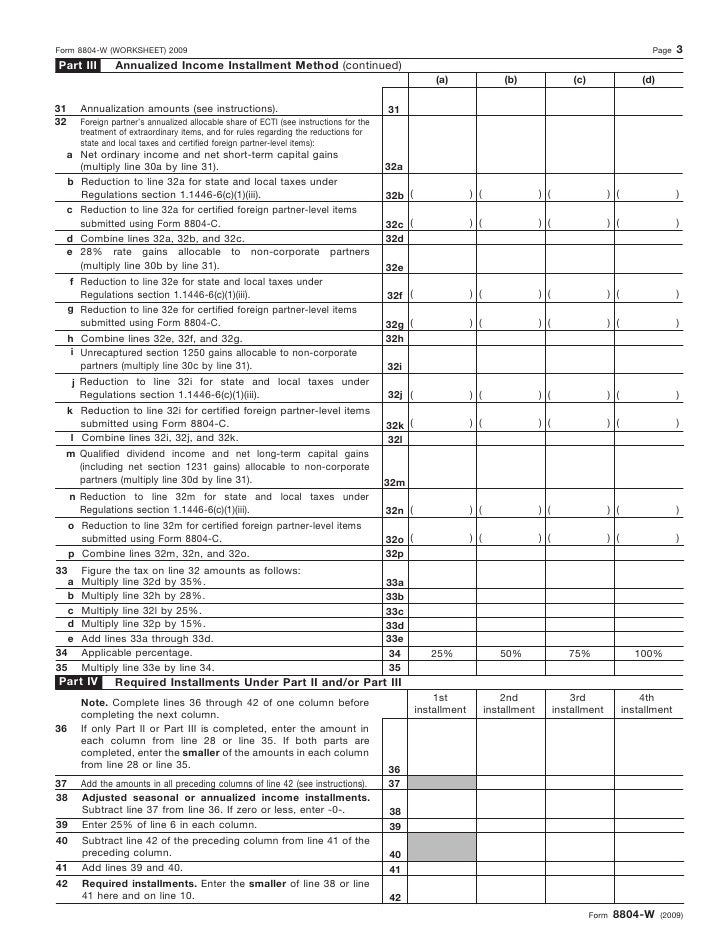

When using an annualized plan, if the taxpayer's payments are less than the calculated minimum required, Planner CS calculates the underpayment penalty in the Payments > Underpayment tab using the Form 2210 Annualized Income Installment Method worksheet.

Internal Employees

This information is not current and is being provided for reference purposes only

IP 2007(18)

Guide to Calculating Annualized Estimated Corporation Business Tax Installments and Worksheet CT-1120AE

Purpose: To explain an alternate method for calculating installments of estimated Connecticut corporation business tax for corporations that do not receive income evenly throughout the year. Under the annualized estimated corporation business tax installment method, the required installment for one or more periods may be less than the amount of the installment calculated using the regular installment method.

Effective Date: Upon issuance.

Statutory Authority: Conn. Gen. Stat. §12-242d.

1. Who should pay estimated corporation business tax? Every corporation carrying on business or having the right to carry on business in Connecticut, whose current year tax exceeds $1,000 after applying corporation business tax credits, must pay estimated tax in four installments, or be subject to interest on the underpayment of estimated tax.

Download film tinkerbell sub indo. Nobita Little Space War:Jika mau Download Film Di atas Klik ini:Jika mau Download Subtitle Indonesia nya klik:7.

A corporation that made an estimated tax payment in the prior income year or whose corporation business tax liability exceeded $1,000 for the prior income year will receive four preprinted estimated tax payment coupons with instructions from the Department of Revenue Services (DRS).

2. What is the corporation’s required annual payment? The corporation’s required annual payment is the lesser of:

- 90% of the tax shown on the Connecticut corporation business tax return for the current income year, or if no return is filed, 90% of the tax for the year; or

- 100% of the tax shown on the Connecticut corporation business tax return for the previous income year without regard to tax credits, if the previous income year was an income year of 12 months and if the company filed a return for the previous income year showing a liability for tax.

3. When should the corporation file? For calendar year filers, the estimated corporation business tax installments are due March 15, June 15, September 15, and December 15. Fiscal year filers should file estimated payments on or before the fifteenth day of the third, sixth, ninth, and twelfth months of the income year. If the due date falls on a Saturday, Sunday, or legal holiday, the next business day is the due date.

4. How much is due with each installment? Generally, a company must pay the required annual payment in four installments as computed on Forms CT-1120 ESA, ESB, ESC, and ESD, Estimated Corporation Business Tax, or Forms CT-990T ESA, ESB, ESC, and ESD, Estimated Unrelated Business Income Tax. However, a company that does not receive income evenly throughout the year, because more income was earned later in the year than in the early part of the year, or for any other reason, may benefit from using the annualized income installment method. The amount due with each payment may vary depending upon the amount of income earned during the period preceding the due date of each installment. One or more payments may be reduced or eliminated for periods in which a company’s income is low and larger payments may be required during the remaining periods when its income is higher.

5. How does the corporation calculate the amount of each installment using the annualized estimated corporation business tax installment method?

Complete Worksheet CT-1120AE on Page 4 of this publication. The corporation must complete one entire column before continuing to the next column. Enter the amount from Line 19 of the appropriate column of the worksheet on Line 5 of Forms CT-1120 ESA, ESB, ESC, and ESD or Forms CT-990T ESA, ESB, ESC, and ESD.

6. How does the corporation pay its estimated corporation business tax? For a fast, easy, and free way to remit the estimated corporation business tax, the DRS website at www.ct.gov/DRS allows the corporation to use the Taxpayer Service Center (TSC) to file Forms CT-1120 ESA, ESB, ESC, and ESD and pay the tax due. Visit the DRS website and select the File/Register OnLine option.

DRS requires those taxpayers who paid tax in excess of $10,000 the prior year to pay the current year liability electronically. Visit the DRS website for more information on making electronic payments, select the FAQ’s - Taxpayer Answer Center option, and search 'Electronic Funds Transfer.'

A corporation that does not otherwise choose to use the TSC must use the preprinted coupons received from DRS. A corporation that does not receive preprinted estimated coupons should use the TSC or the estimated coupons available on the DRS website.

7. What if the corporation underestimates its corporation business tax? If the current year tax is more than $1,000 and the corporation does not make timely installments of its required annual payment, it will be charged interest on the underpayment. Interest will accrue on the amount of the underpayment until the earlier of the first day of the fourth month following the end of the income year, or the date on which the underpayment is paid.

8. Will interest apply if the corporation uses the annualized estimated corporation business tax method? Interest will not apply if the required installments are calculated correctly. Complete Worksheet CT-1120AE, and make the required installment payments (using Forms CT-1120 ESA, ESB, ESC, and ESD or Forms CT-990T ESA, ESB, ESC, and ESD) on or before the due dates.

9. May the corporation apply overpayments in the current year to the next year’s estimated corporation business tax? When the corporation’s current year return is filed, the corporation may apply overpayments of Connecticut corporation business tax to the estimated tax for the following income year. The request to apply overpayments to the next year's estimated tax is irrevocable, and the credit is established as of the date of the U.S. Postal Service cancellation mark on the completed return, or if the return was electronically filed through the TSC, the date the return was successfully transmitted.

Effect on Other Documents: This Informational Publication 2007(18) supersedes Informational Publication 2006(19) which may no longer be relied upon on or after the issuance date of this publication.

Effect of This Document: An Informational Publication issued by DRS addresses frequently asked questions about a current position, policy, or practice, usually in a less technical question and answer format.

For Further Information: Call DRS during business hours, Monday through Friday:

- 1-800-382-9463 (Connecticut calls outside the Greater Hartford calling area only), or

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling 860-297-4911.

Forms and Publications: Forms and publications are available anytime by:

- Internet: Visit the DRS website to download and print Connecticut tax forms; or

- Telephone: Call 1-800-382-9463 (Connecticut calls outside the Greater Hartford calling area only) and select Option 2 from a touch-tone phone, or call 860-297-4753 (from anywhere).

IP 2007(18)

Corporation Business Tax

Estimated Taxes

Issued: 10/29/2007